Court Concerned about JG Wentworth's Lowball Pricing Tactics

Upon the foregoing papers, it is ordered that the petition for an order approving the transfer of structured settlement payment rights is determined as follows:

Upon the foregoing papers, it is ordered that the petition for an order approving the transfer of structured settlement payment rights is determined as follows:

Petitioner J.G. Wentworth Originations, LLC ("Wentworth") makes the instant application, pursuant to General Obligations Law, Title 17, known as the Structured Settlement Protection Act ("SSPA"), for an order approving the transfer of payment rights vested in Jenny Arce ("Arce") under a structured settlement obligated and funded by American Home Assurance Company and American International Life Assurance Company of New York ("American"), respectively.

The Facts About JG Wentworth's Chapter 11 Bankruptcy

After receiving approval by a Delaware judge, JG Wentworth received $100 million from their parent, private equity firm JLL Partners of New York. This boost significantly helps JG Wentworth continue to operate their ongoing business.

Now that JG Wentworth's bankruptcy plan was accepted, they have zero debt and enough cash to operate for the foreseeable future.

JG Wentworth Files For Chapter 11 Bankrupcy

Today, JG Wentworth announced that three of its non-operating parent holding company level affiliates – JGW Holdco, LLC, J.G. Wentworth LLC, and J.G. Wentworth, Inc., -- have filed a voluntary reorganization plan under Chapter 11 of the U. S. Bankruptcy Code in the U. S. Bankruptcy Court for the District of Delaware.

JG Wentworth Gains Satisfactory Rating Back Overnight

Settlement Quotes strives to make our blog entries current. Yesterday this author published an article "JG Wentworth Loses Satisfactory Rating From the BBB," in the article this author discusses how JG Wentworth has had their satisfactory rating removed from their Better Business Bureau profile.

Within a period of 12 hours, JG Wentworth's rating went from unsatisfactory to satisfactory. J.G Wentworth's BBB profile was under review for a three week period throughout September. Once their profile came back online on October 3rd, 2008 their profile was stripped of the satisfactory rating.

JG Wentworth Loses Satisfactory Rating

As of October 5th, 2008, JG Wentworth has officially been stripped of it's satisfactory rating from the Better Business Bureau.

"To have a "satisfactory BBB Rating" with BBB, a business must be in business for at least 12 months, properly and promptly address matters referred to it by BBB, and be free from an unusual volume or pattern of complaints and law enforcement action involving its marketplace conduct. In addition, BBB must have a clear understanding of the business and no concerns about its industry."

Kudos to JG Wentworth in their Recent Press Release

Here is a snippet of J.G Wentworth's recent press release:

- Do your research on firms that can purchase your structured settlement to ensure they have a reputation of offering fair value.

- Do not take the first offer to purchase your policy, but shop around to get the most value for your structured settlement.

- Depending on your financial needs, decide on whether you need to sell your entire structured settlement or just part of it.

- Consult with an attorney to make sure you understand and document any tax ramifications.

- Think about your financial needs going forward and how selling all or part of your structured settlement may impact your income later.

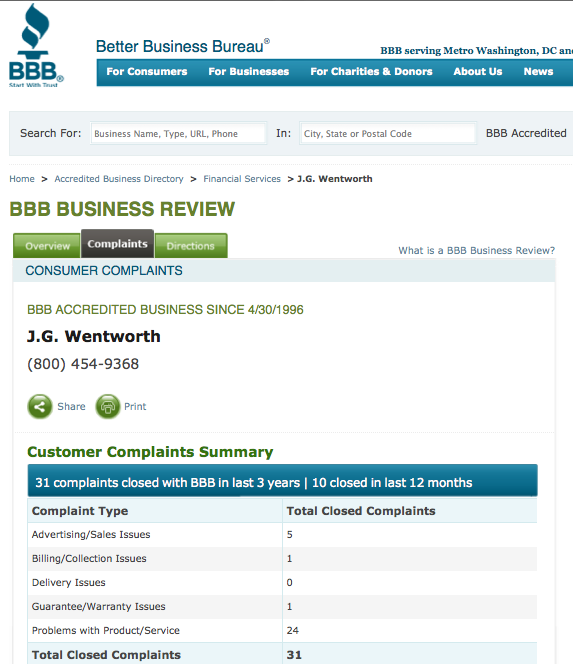

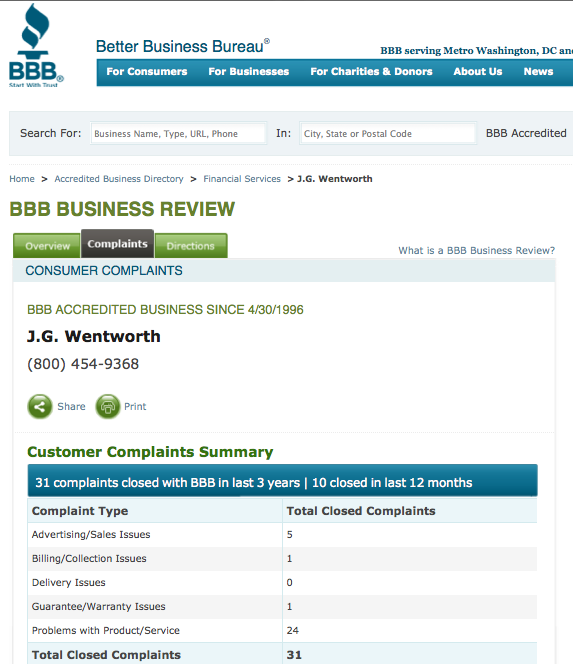

JG Wentworth Improves BBB Record

Updated January 2012 - How important is a company's reputation when purchasing structured settlement payments from tort victims? JG Wentworth is the largest company in the structured settlement factoring industry, but it's important to note this company's Better Business Bureau record. JG Wentworth has done a good job over the past 2 years of cleaning up their record. This article was originally written in 2008 and JGW had over 40 BBB complaints. Looking at their record now, they have just over 30. This is impressive with all that has happened in the 4 years since this article was written.

Updated January 2012 - How important is a company's reputation when purchasing structured settlement payments from tort victims? JG Wentworth is the largest company in the structured settlement factoring industry, but it's important to note this company's Better Business Bureau record. JG Wentworth has done a good job over the past 2 years of cleaning up their record. This article was originally written in 2008 and JGW had over 40 BBB complaints. Looking at their record now, they have just over 30. This is impressive with all that has happened in the 4 years since this article was written.

Over the past four years, JG Wenworth has filed for bankruptcy, laid off over half its workforce, and merged with it's biggest competitor Peachtree Settlement Funding.

JG Wentworth has received 10 complaints over the last 12 months and 31 complaints over the past 36 months. The increased number of complaints within the last 12 months could be due to the merger with Peachtree. I would suspect that they are doing almost double the business, and most of it is being funneled through JG Wentworth, not Peachtree. Nevertheless, Peachtree also has 3 complaints in the past 12 months and 9 complaints for the last 3 years.

The comparison of the number of complaints over the last three years may be a far better indicator of customer experience than the BBB Rating alone.

Upon the foregoing papers, it is ordered that the petition for an order approving the transfer of structured settlement payment rights is determined as follows:

Upon the foregoing papers, it is ordered that the petition for an order approving the transfer of structured settlement payment rights is determined as follows:

Updated January 2012 - How important is a company's reputation when purchasing

Updated January 2012 - How important is a company's reputation when purchasing