How Do I Sell My Annuity?

Annuitized payments can help offset your bills by providing a stable, reliable source of income over the long term. Most annuities are paid out over a significant period of time (including lifetime payments), which can offer considerable peace of mind for those with a limited income. However, that doesn’t mean that structured payments are ideal for all situations. If you’re asking yourself how do I sell my annuity, chances are good you’re dealing with this type of situation.

Is Your Need Applicable?

First, understand that you cannot sell your annuity for just any old reason. You can’t sell your payments so you can afford a nice vacation. You can’t sell just because you want to buy an RV or want to invest in a second home. All structured settlement sales (including your annuity) have to go before a judge who will determine if there is a need for the sale. That means that the first criteria you have to meet is need – your financial situation must be such that selling your annuity will be beneficial (or vital).

Find Offers

Once you determine if your need is likely to be applicable for sale approval by a judge, you need to find companies that buy annuities. There are plenty of them out there, but it can be hard to locate and contact them on your own. This will require significant legwork and time invested. Once you find several companies, you’ll need to get them to submit an offer and then vet the various offers.

Work with a Reputable Structured Payment Company

There’s an alternative to going it alone in this tricky situation. You can work with an experienced structured settlement company that has connections to the most reputable companies that buy annuities. When answering the question of how do I sell my annuity, having a helping hand in the process is invaluable. With the right brokerage, you can start receiving offers to buy your payments within mere minutes of submitting your information.

It’s not all about speed, though. Another benefit of working with a brokerage is the fact that you benefit from their experience and connections. This company works on your behalf to ensure that not only do you receive offers fast, but that those offers come from reputable buyers rather than unscrupulous companies. As you can imagine, that helping hand can provide some significant peace of mind, as well as a faster process.

Structured Settlement Factoring- Buyers Market

This following post is a guest post by Dominic Orsel. Dominic is a day trader based out of Sacramento California.

This following post is a guest post by Dominic Orsel. Dominic is a day trader based out of Sacramento California.

With the increased volatility of the stock market over the last few months, both equity firms and private investors are pouring money into the more secure annuity market. It is important for tort victims to realize the signifigance of their structured settlement in todays financial marketplace. Investors are becoming increasingly interested in these financial vehicles due to the security that they provide with the up and down movement of todays stock market.

How Soon Will I Receive My Lump Sum of Money?

This question was asked to Settlement Quotes from an individual interested in selling the rights to their structured settlement payments. There are several factors that go into the time it takes to complete a structured settlement factoring transaction, including the state the annuitant resides in, the insurance company, and the factoring company completing the transaction. In most cases the transaction should be completed in 6- 8 weeks.

This question was asked to Settlement Quotes from an individual interested in selling the rights to their structured settlement payments. There are several factors that go into the time it takes to complete a structured settlement factoring transaction, including the state the annuitant resides in, the insurance company, and the factoring company completing the transaction. In most cases the transaction should be completed in 6- 8 weeks.

JG Wentworth Improves BBB Record

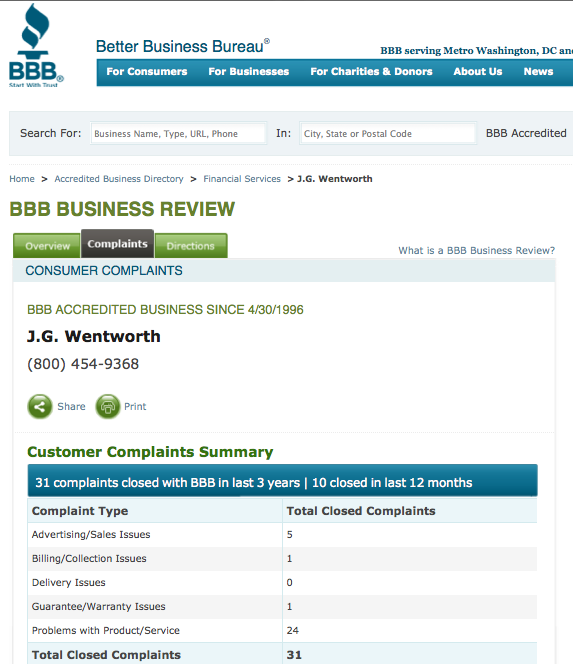

Updated January 2012 - How important is a company's reputation when purchasing structured settlement payments from tort victims? JG Wentworth is the largest company in the structured settlement factoring industry, but it's important to note this company's Better Business Bureau record. JG Wentworth has done a good job over the past 2 years of cleaning up their record. This article was originally written in 2008 and JGW had over 40 BBB complaints. Looking at their record now, they have just over 30. This is impressive with all that has happened in the 4 years since this article was written.

Updated January 2012 - How important is a company's reputation when purchasing structured settlement payments from tort victims? JG Wentworth is the largest company in the structured settlement factoring industry, but it's important to note this company's Better Business Bureau record. JG Wentworth has done a good job over the past 2 years of cleaning up their record. This article was originally written in 2008 and JGW had over 40 BBB complaints. Looking at their record now, they have just over 30. This is impressive with all that has happened in the 4 years since this article was written.

Over the past four years, JG Wenworth has filed for bankruptcy, laid off over half its workforce, and merged with it's biggest competitor Peachtree Settlement Funding.

JG Wentworth has received 10 complaints over the last 12 months and 31 complaints over the past 36 months. The increased number of complaints within the last 12 months could be due to the merger with Peachtree. I would suspect that they are doing almost double the business, and most of it is being funneled through JG Wentworth, not Peachtree. Nevertheless, Peachtree also has 3 complaints in the past 12 months and 9 complaints for the last 3 years.

The comparison of the number of complaints over the last three years may be a far better indicator of customer experience than the BBB Rating alone.

Structured Settlement Quotes and the Factoring Industry

John Darer wrote an interesting article: Should Factoring Companies Use of Search Engine Optimization Be Suspect? As Mr. Darer points out, the SERP is full of structured settlement factoring companies who are providing structured settlement FACTORING quotes. As a factoring company, I believe it would be in the factoring industries best interest to show companies that can provide legitimate structured settlement quotes.